Invoice factoring is an increasingly popular financial tool that allows businesses to generate quick cash by selling invoice balances at a discount.

As demand grows, it’s important for those considering factor financing to understand and respond effectively to common objections voiced before signing up.

Here we will examine some of the most frequent responses heard when discussing extending invoice payment terms with customers and how business owners can successfully overcome them in order to take advantage of this sizable benefit.

At its core, factoring provides fast access to capital which permits companies significant flexibility heading into a range from payroll expenses all away through making larger investments such as buying equipment or expanding their workforce.

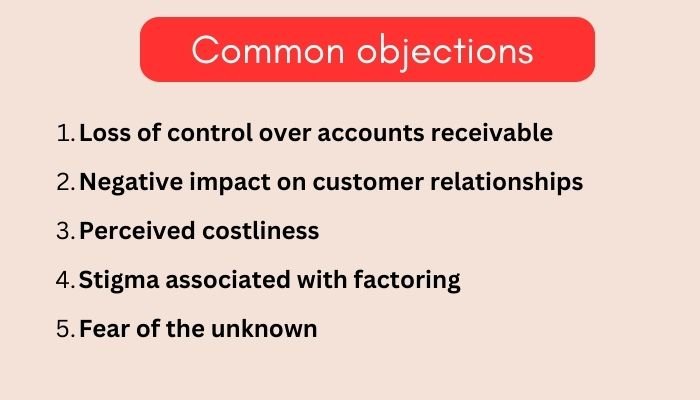

Common objections to invoice factoring

1. Loss of control over accounts receivable

When dealing with invoice factoring, one of the most commonly expressed objections has to do with loss of control over accounts receivable.

Customer or vendor relationships are important and business owners fear that this type of arrangement may have a negative impact on these connections.

Moreover, many worry about losing direct contact with their clients thereby relinquishing some degree of autonomy in those commercial partnerships.

It is important for businesses considering invoice factoring to address such concerns head-on instead immediately dismissing them out-of-hand lest they lose an opportunity at greater liquidity down the road due solely by not responding adequately at first.

2. Negative impact on customer relationships

Negative impact on customer relationships is one of the most common objections to invoice factoring.

Companies are concerned that customers may think they cannot pay their bills in full, as an implication that something has gone very wrong with finances if a third party had to be brought in for payment collection.

In order to overcome this objection, it’s important for companies looking into factorizing invoices understand and explain facts about the process; educate their clients about how timely payments can benefit both sides of the relationship; start off by offering services without bringing attention or making much fuss until term gain visibility among accounts receivable departments from suppliers and help business owners maintain control over collections processes while still allowing brokers secure appropriate collateral requirements when needed.

3. Perceived costliness

Perceived costliness is a common objection to invoice factoring.

Despite the costs of accounting, interest payments and outsourcing receivables administration being lower than traditional banking loans for short-term financing, many businesses have difficulty seeing past their immediate cash flow requirements and recognize that this type of financing can be beneficial in the long term with more flexibility as well.

In addition, it allows companies to get paid faster so they don’t need to wait weeks or months before getting access to much needed capital which improves efficiency drastically over time given fewer transaction fees due from waiting periods between payouts.

4. Stigma associated with factoring

Invoice factoring often carries an unfortunate stigma associated with it, including the perception of desperation or lack of financial savvy.

This is due to a general misunderstanding about invoice factoring and how businesses can maintain control over accounts receivable while taking advantage of its various benefits.

What the actual truth is when done correctly, invoice factoring eliminates stressful cash flow issues without compromising customer relationships or professional credibility. It’s indeed important for business owners to understand this concept so they don’t miss out on solutions during times of need.

5. Fear of the unknown

Fear of the unknown is a common objection to invoice factoring.

Business owners may be hesitant about making such an important decision without knowing all its potential outcomes and risks- to overcome this fear, business owners should first educate themselves on the different types of factoring services available and how it can benefit them financially in terms of increasing cash flow quickly with low fees.

Responses to overcome objections

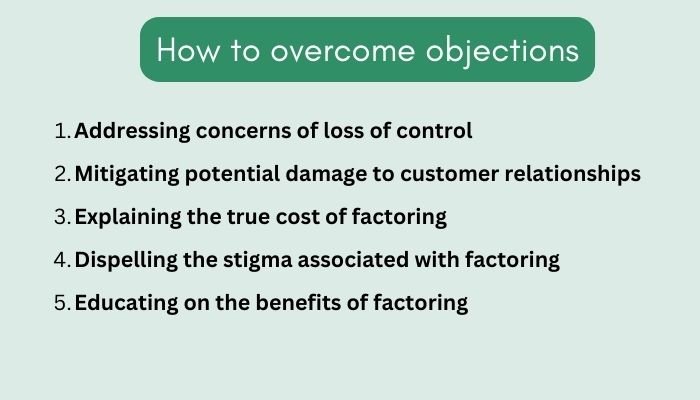

1. Addressing concerns of loss of control

Businesses may be concerned about losing their control over accounts receivable when factoring invoices.

However, best-in-class invoice factoring companies allow businesses to maintain complete visibility and access into the status of all relevant customer quotes, orders, and payments; the business also retains its right to approve, reject or contest any transaction occurring via the platform if that situation arises.

Furthermore, high quality options exist for separating collections activity from operations personnel within a company’s existing team structure in order to ensure efficient responses as well as separation between roles/responsibilities where appropriate.

2. Mitigating potential damage to customer relationships

Mitigating potential damage to customer relationships can be tricky when introducing invoice factoring into a business.

Businesses need to make sure their clients understand the process of factoring and agents must deliver messages with tact and sensitivity in order for clients not to feel pressured or offended.

It is also important for businesses use technology such as digital payments so that customers do not have hands-on communication with any other third parties involved, thus avoiding possible compromise on privacy concerns.

3. Explaining the true cost of factoring

Explaining the true cost of factoring can be key to overcoming objections. Through education and mutually beneficial agreements, businesses should feel comfortable that opting for invoice factor does not exceed their budget.

Companies must understand all associated fees including lender’s service charge or discount rate, origination fee etc., in order to make an informed decision about whether it is the right choice for them financially.

4. Dispelling the stigma associated with factoring

Dispelling the stigma associated with factoring is an important part of overcoming many objections. Factoring is a legitimate form of financing that has been used by businesses for centuries, and can be beneficial when seeking capital to grow or maintain operations.

By demonstrating its legitimacy through historical evidence as well as comparison to other forms of borrowing, it’s possible to show customers and stakeholders alike how invoice factoring could prove advantageous in specific situations such as cash flow management.

Additionally, creating transparency around pricing structures helps demonstrate the cost savings offered through properly implemented factor arrangements.

5. Educating on the benefits of factoring

One response to overcome objections to invoice factoring is educating on the benefits of invoicing.

Companies need cash flow in order for their business operations and growth strategies, so a clear explanation should be given as to why they should use factoring services: no cost associated with collecting payments from customers, fast access to capital without debt financing or diluting equity through investors, greater insight into customer creditworthiness and other useful financial data.

All these advantages can help businesses make more informed decisions about how best manage resources.

Conclusion

Overall, invoice factoring can be an important tool for businesses to consider when they are looking at their financing options.

By understanding and addressing the common objections associated with it – including loss of control over accounts receivable, potential damage to customer relationships, perceived costliness, stigma, and fear of the unknown – a business or organization can seize all its advantages.

This allows them to efficiently manage cash flow without compromising profit margins or capital gains in investments opportunities that could otherwise go untapped due to financial constraints.