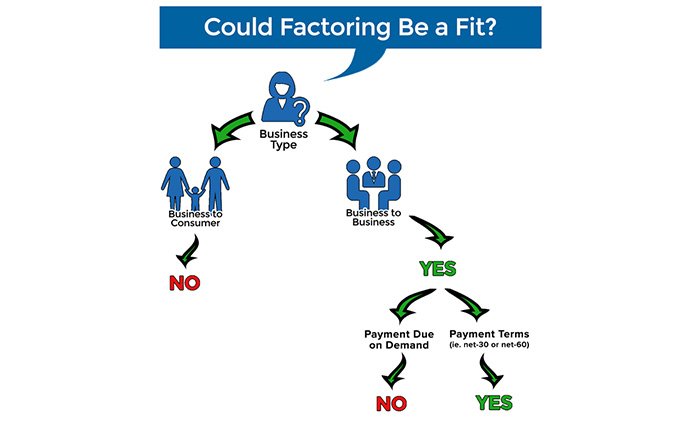

Debt factoring is a financing method used in business that involves selling debts to a third party, known as the factor. This type of transaction between businesses enables faster access to money owed and improves short-term cash flow management through the immediate collection. As this form of finance has grown more popular with companies around the globe, understanding its key elements and benefits can be incredibly helpful for making informed decisions about financial strategies.

In this article we will explore debt factoring in detail; from its definition and different types available, how it works step-by-step process overviews up until case studies that prove successful examples within real-world applications related back to small business needs or start-up capitalists seeking fast ways within their budget restrictions.

We’ll also discuss potential drawbacks/risks involved if not properly managed before coming towards our conclusion highlighting all discussed summary points considered thoroughly throughout without leaving out any relevant details when opting towards including debt facts Read on ahead to discovering the positives & negatives associated with taking such methods into consideration at firsthand!

Contents

Understanding Debt Factoring

Debt factoring is a financial transaction in which a company (the debtor) sells its unpaid customer invoices and accounts receivables to another party, typically known as the factor.

The factor then pays an advance amount for the invoices before collecting payments from customers or debtors on behalf of the debtor while also managing credit risk by conducting a due diligence process such as verifying account information or confirming payment terms. In return, they charge some fees associated with debt collection services rendered to cover their costs.

How Debt Factoring Works (Step-by-step process)

1. Assessment of the debtor’s creditworthiness

Assessment of the debtor’s creditworthiness is an essential step in the debt factoring process. Here, a review and analysis of existing data such as financial statements and reports are done to determine if the proposed debtor has enough funds or assets that can be used to pay off their debts.

Credit ratings, payment history, and collateral ownership status also play important roles here which factor into both pricing terms set by creditors as well as overall decision making on whether extending finance through debt factoring would lead to positive outcomes for all parties involved.

2. Agreement between the factor and debtor

Once the debtor’s creditworthiness has been assessed, both parties must agree to a contract. The agreement should outline all terms and conditions of the factoring process including fees, payment schedule, and due dates for invoices submission.

It is important that each party understands their individual obligations in order to ensure the successful completion of transactions on time with minimal disputes or misunderstandings between them.

3. Submission and verification of invoices

The submission and verification of invoices is an important part of the debt factoring process. The factor requires copies of relevant invoices with all discounts taken, as well as any other supporting documents required to verify that purchase orders have been fulfilled before releasing payment for them.

All parties involved in each transaction must agree on a predetermined timeline for payments and should maintain communication until applicable fees are paid off by the debtor. Upon successful completion, funds will be transferred from the factor to both the creditor and debtor according to their respective agreements within 24-48 hours – usually sooner than traditional bank transfers or financing options offered!

4. Advance payment and collection process

The advance payment process in debt factoring starts when the factor advances a predetermined amount of money as an initial loan. The invoice that is submitted to the factor by the debtor is then verified and authenticated along with other documents required for closing this transaction.

After due diligence, funds are advanced typically within 24 hours after submission and authentication of invoices which can be used mainly for working capital needs or making bulk purchases at discounted prices from suppliers, etc.

Once goods are made available/delivered to customers according to terms stated on respective invoice(s), it’s time for collection phase which will take around 3-4 weeks post delivery depending upon cash availability/credit period granted by customer before payables get settled with final payments against credited invoices done between factor & creditors usually through cheque payment procedure via bank transfer systems thereby concluding all transactions related towards debt factoring services contracted out previously.

5. Settlement and final payment

The process of debt factoring eventually comes to a close when the factor is paid back in full. The settlement and final payment mark the end of this agreement between the parties involved, including the debtor, factor and creditor.

After verifying invoices have been submitted via invoice facilitation or maturity periods, advance payments are then collected which constitute factors’ commission fees taken out by their percentage upfront – ultimately resulting in settling debits with creditors while paying off any remaining balance accumulated throughout prior transactions.

As such, understanding terms associated with debt collection along with each party’s responsibility helps secure settlements peacefully for all participants thus providing lenders an avenue to maintain financial stability until other sources are secured down-the-road if necessary.

Benefits of Debt Factoring

Improved cash flow

Debt factoring offers a range of benefits, including improved cash flow. With debt factoring, businesses are able to receive immediate access to funds without having to wait for customer payments or worry about additional financing options. This enables companies with slow-paying customers and tight budgets the ability to take advantage of opportunities that may have otherwise been unavailable due to lack of capital resources.

It also allows them more flexibility in managing their money by providing short-term liquidity when needed most. Furthermore, it minimizes the hassle associated with traditional lending processes such as loan applications and strict collateral requirements making this option far less time intensive than other sources of finance.

Reduction in credit risk

Debt factoring provides an opportunity for businesses to manage credit risk by reducing their exposure. The factor takes on the role of assessing and collecting debts, thus eliminating potential loss on account of customer non-payment or default.

Such a transaction also affords companies access to immediate payment in exchange for invoices—thereby freeing up cash flow without having to worry about debt collection complexities. In essence, when opting for this form of financing over traditional bank loans as well as other forms alternate lending options such as invoice discounting allows organizations reduce their liability against bad customers while ensuring healthier financial stability even during times of crisis.

Access to immediate funds

Debt factoring provides access to immediate funds through the process of advancing payment on outstanding invoices. This way, businesses can quickly receive large payments without having to wait for customer debt collection cycles that may take months or even years depending on creditworthiness and internal processes.

Furthermore, by opting into a factor agreement with an independent provider like Access Commercial Capital instead of relying entirely upon traditional financing methods such as bank loans, small business owners are able to reduce risks associated with extended debts while benefiting from increased cash flow stability in times where initiating financial returns otherwise proves difficult.

Outsourcing of accounts receivable management

One important benefit that debt factoring provides is the outsourcing of accounts receivable management. The factor takes care of invoicing, collections, and other activities all related to an organization’s finances as it pertains to AR/credit customers. Benefits include streamlining company operations while allowing a business owner more time in areas such as sales or product expansion since they no longer have to manage customer payments themselves.

Additionally, this can reduce costs.. Outsourcing these functions provides reliable access when needed along with timelier results due partially on specialized knowledge and end-to-end workflow automation employed by most factors providing services today

Enhanced business growth opportunities

Debt factoring can provide a business with multiple benefits, including the ability to enhance their growth opportunities. By providing access to immediate funds and improved cash flow, debt factoring alleviates some of the financial pressure businesses experience while expanding or entering new markets.

Additionally, outsourcing accounts receivable management saves time that could be better spent focusing on other areas of operations such as those associated with growing your business.

With debt factoring services available in many forms tailored for specific needs and goals companies are able to efficiently manage finances without having to worry about collection processes instead devoting more resources towards bolstering sales figures which would enable better visibility into potential future investments beyond mere day-to-day performance metrics.

Factors to Consider Before Opting for Debt Factoring

Cost and fees associated with debt factoring

When considering debt factoring, it is important to be aware of the associated costs and fees. Factors usually charge a commission fee as well as an interest rate on advances or amounts due before customers remit payments in full.

Make sure that these charges are reasonable and don’t eat into potential profits too much; compare them with other financing options available if necessary. Also, keep in mind that factors often charges monthly maintenance fees even when there is no activity reported during certain periods.

Impact on customer relationships and reputation

When considering debt factoring, it’s important to keep in mind potential impacts of the arrangement on customer relationships and reputation. Many customers take note when their payment history is sold off in order for a business to gain favorable financial terms; as such, it’s integral that firms are prepared with how best to communicate this process without creating bad publicity or damaging existing trust with clientele. In advance of signing up for debt factor agreements, companies should review policies around disclosure – ensuring specified guidelines align closely.

Compatibility with business goals and operations

Compatibility with business goals and operations is a critical factor to consider before opting for debt factoring services. Companies should evaluate if the terms of their agreement facilitate meeting financial objectives while allowing them to remain autonomous in their day-to-day dealings with customers.

The facts that have been determined must be realistic, affordable, transparently communicated between all parties involved, and beneficial both from an operational standpoint as well as overall profitability viewpoint. To ensure compatibility with ongoing development strategies it’s essential that companies explore ways not only to alleviate current cash flow issues but also guard against major financial losses stemming from defaulting debts or unforeseen complications down the road.

Comparison with alternative financing options

Before choosing debt factoring as a financing option, it’s important to compare the costs and benefits of this strategy with other types of funding. Investigating alternative solutions can help ensure that businesses make wise financial decisions when faced with cash flow issues or liquidity shortages.

Some popular options include secured business loans, asset-based lines of credit (ABL), invoice discounting platforms, Mezzanine finance companies, SBA loan guarantees and more. An ability to weigh out each available solution is essential for finding the approach that best fits your needs in terms of cost efficiency and potential access to capital.

Potential Drawbacks and Risks of Debt Factoring

Dependency on customer payments

The primary drawback and risk associated with debt factoring is its dependency on customer payments. Factors must rely solely on the debtor to make prompt, accurate payment for goods or services rendered before they can receive their money from the creditor.

Any delay in payment could affect cash flow projections, resulting in decreased profits for both creditors and factors alike. As such, businesses should thoroughly assess any potential risks that may be incurred through this type of financing option prior to committing themselves entirely.

Possible negative impact on profit margins

Debt factoring can have a negative impact on profit margins if the fees charged by the factor are too high. The lender will want to cover their own costs and make a healthy return, meaning debtors may be hit with higher rates that reduce profitability in comparison with other types of financing solutions. Additionally, businesses must carefully consider any potential reputational risks associated with outsourcing accounts receivable management before deciding whether or not it’s right for them.

Potential loss of control over debt collection process

One potential drawback to debt factoring is a possible loss of control over the debt collection process. Since accounts receivable are transferred from the original debtor to the factor, this responsibility would then be transferred as well. This means that businesses may no longer have full authority and ownership in tracking down outstanding payments from customers or maintaining customer relationships when it comes to their debts. Businesses should weigh these risks carefully before opting for riskier forms of financing such as debt factoring.

Conclusion

Debt factoring can be a great financial tool for businesses looking to manage their debt effectively and access funds quickly. This article has explored the basics of how it works, as well as its benefits and drawbacks.

Through serious research into all parties involved in the process – factor, debtor, creditor – business owners will gain insight on which type of debt factoring may best serves their needs without compromising future goals or operations.

Overall, when used smartly and judiciously managed by those knowledgeable about finance risks factors such as cost implications need to also be considered closely so potential pitfalls are avoided. Debt Factoring offers numerous advantages from enhanced cash flow through improved credit rating therefore we encourage small businesses considering this option explore at length if would suit them before putting any plans into action.